Key questions you should ask when planning your legacy

Imagine it’s your 100th birthday, and someone is about to make a toast in your honour. What would you want them to say?

I like to ask this question to help people think about their values, what really matters to them and their legacy. It makes us pause and reflect: what do I want to do with this life I have been given and how do I wish to be remembered?

Every single person, regardless of how much money or property they have, can leave a meaningful legacy and be remembered for the good they have done long after they are gone.

For many people, a charitable gift in their will is an important part of planning their legacy. Taking care of family, children and close friends always comes first—but many SFU donors have found that leaving even a small percentage of their estate is enough to create a permanent named endowment that will last forever. A thoughtful bequest gift can carry on your values and beliefs well into the future and help countless people.

What you may not realize is that a well-planned gift to SFU not only helps future students and researchers, but can also potentially reduce taxes paid by your estate and probate fees as well as reduce or eliminate capital gains taxes.

Here are some options you may wish to consider when making your estate plans:

- Can I leave a legacy gift? First plan for how you will take care of family and friends. Many donors realize that they can provide for family and friends and still have room to leave a gift to a charitable cause in their will.

- Would I like to have an endowment named for me or someone I care about? For a gift of $20,000, you can create an endowment to support SFU which will last forever in perpetuity. For many people this translates to as little as 2%-5% of their total estate.

- Will my estate have to pay taxes? Certain assets like appreciated securities in your estate may be taxed heavily. Donating these assets to SFU may eliminate capital gains taxes and provide a tax credit for your estate.

- Can I reduce probate fees? Many people want to reduce probate fees if they can. Naming SFU the direct beneficiary of life insurance policies or RRSPs can be a way to eliminate probate fees on these assets and provide for a lasting legacy.

The SFU Gift & Estate Planning team is happy to discuss the options with you further at any time and provide sample wording to make it easier for your lawyer or notary when drafting your will. Thank you for taking the time to consider your legacy and all you do to create a better world through an investment in education.

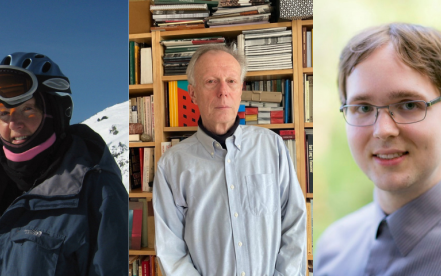

Grant Monck, LL.B.

Grant Monck is a member of the Law Society of British Columbia, Estate Planning Council of Vancouver, and Senior Counsel with PGgrowth. Grant has been involved with charitable giving and estate planning in BC for over 20 years working for and advising charities, donors and their advisors on philanthropic giving.