Securities options

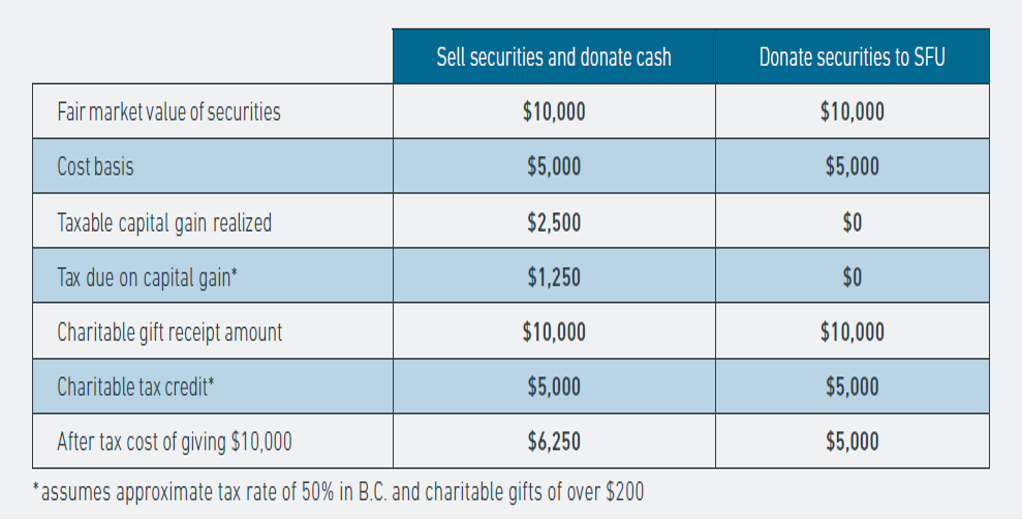

Donating appreciated securities is simple, cost-effective and the most tax-efficient way to make a charitable gift.

You can make a charitable gift of securities, such as shares of the capital stock of a corporation, units of mutual fund trust, exchange traded funds (ETFs), government savings bond, corporation bonds, shares, warrants and futures that are listed on a designated stock exchange.

There may be special conditions for gifts of private shares, employee stock option shares, flow-through partnership units and securities sold at a loss.

Benefits to you:

- Capital gains income on securities that have been donated to charity are non-taxable—the entire donation amount results in a tax credit.

- Straightforward and easy to transfer—your broker can usually execute a transfer in one or two days.

- Your charitable tax receipt is equal to the closing value of your securities on the date the securities are received in SFU’s account.

- The proceeds from your securities are directed to the area of your interest.

- You can deduct the entire gift in the current year or carry taxes credits forward for up to five years.

You can deduct the entire gift in the current year or carry taxes credits forward for up to five years.

Illustration of tax savings

Stock options

Donations involving employee stock options in a public company can be one of the most tax efficient ways to make a donation.

Normally, when stock options are exercised for personal gain, the difference between the stock's fair market value and its exercise price is considered a taxable employment benefit. This benefit is then taxed as a capital gain, such that 50% of the profit is counted as income; employers must withhold the required taxes on that amount, including EI and CPP.

However, charitable gifts arranged by donating stock options can result in a high value gift at low cost.

Benefits to you:

- Reduced cost of giving

- Simple transaction

- Maximized tax benefits

How to gift securities & stocks

Step 1:

- Please contact SFU Advancement Administration at pgadmin@sfu.ca to request a securities & stock donation form.

Step 2:

- Complete the securities & stock donation form and send it to your broker, or financial advisor or investment firm to initiate the transfer. Please note that the university cannot initiate a transfer. If you do not have a broker or financial advisor, send this form directly to your investment firm.

Step 3:

- Forward a copy of the completed donation of securities form to: Don Foster, SFU’s Corporate Investment Advisor at don.foster@nbpcd.com and SFU Advancement Administration at pgadmin@sfu.ca.

This will ensure a receipt for income tax purposes is issued and funds are allocated to the area of your choice. For more information, please contact SFU Advancement Administration at pgadmin@sfu.ca