How to plan to reduce taxes on your estate: Part two in a three-part series

Article by Pamela Yoon, SFU alumnus and RBC Dominion Securities Senior Portfolio Manager

Regardless of your age or financial situation, an estate plan can reduce the taxes and expenses of an estate, simplify and speed the transition of assets to your beneficiaries, and ensure beneficiaries are protected.

In this second instalment in a three-part series, we look at some ways to minimize taxes at death and help you leave a lasting legacy (for your family and charitable organizations that you love).

Please note these tips are intended for a Canadian resident who is not a U.S. citizen. If you have dual citizenship or residency in another country, there may be additional strategies and issues you need to consider.

Work with an advisor to help build a proper estate plan

A good advisor will help you figure out your tax liability at death and perhaps utilize life insurance as part of your plan to reduce estate taxes (also called estate shrinkage). Important elements of this estate plan would include an enduring power of attorney, reviewing ownership structures (which assets will pass through probate and which don’t), updating beneficiary designations, how you hold title of your assets or businesses (is it in joint-tenancy or tenants-in-common), inventory of assets (including digital assets and valuable art) and considering charitable giving. Do you have children that you have not provided for in the Will that could challenge your Will? A properly structured Will ensures smooth transition of assets to avoid litigation (because litigation is a de facto estate tax). Ensure that your Will, beneficiary designations and power of attorney documents are valid, up to date and still reflect your wishes.

Trust planning – Inter vivos trusts

Consider the benefits of setting up an inter vivos trust, such as a family trust. An inter vivos trust may be used to income-split with your children or grandchildren or to simply provide ongoing financial support for your children or other family members. An inter vivos trust can also be used as a discrete means of transferring assets to your beneficiaries outside of your estate. Since assets in an inter vivos trust do not pass through your estate, you may be able to avoid probate taxes in most provinces and territories. If you are age 65 or over, an alter ego trust or a joint partner trust (for you and your spouse) may provide you with additional tax and estate planning opportunities (reduction in probate tax, continuous management of property, privacy and confidentiality, protection from estate litigation, alternative to a power of attorney).

Trust planning – Testamentary trusts

Consider creating a testamentary trust in your Will. A testamentary trust is an alternative to an outright distribution of your estate assets. It allows you to control the timing and distribution of assets to your beneficiaries. Testamentary trusts may be used to create solutions to complex family situations, for example, when planning for a child with a disability, a spendthrift beneficiary, minor children or a second marriage. You should consult a qualified legal advisor to discuss the merits of creating a testamentary trust in your Will.

Charitable donations

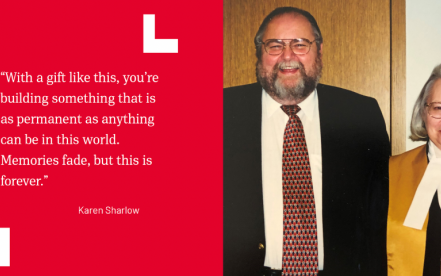

If you have philanthropic intentions, you may want to consider gifting directly to a qualified donee. Qualified donees may be charitable organizations, public foundations, or private foundations. Typically, a registered charity is a qualified donee. You will receive a charitable donation receipt which may reduce your tax bill. Donations can be made while alive or after you are gone (via your estate).

As a proud alumnus, I donate to SFU annually via the Pamela Yoon Award in Economics that supports SFU students wishing to go into the field of finance post-graduation, with a special emphasis on the Chartered Market Technician or the Chartered Financial Analyst program. My philanthropy is intentional and is built into my financial plan.

Before taking any action on any of the strategies discussed in this article, make sure you get qualified professional advice. To learn more, get in touch with Pamela Yoon at pamela.yoon@rbc.com

Want even more tips on giving strategically? RBC Dominion Securities has a 28-page document on charitable giving.

Disclaimer: This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that any action is taken based upon the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein.

The information in this article is not intended to provide legal, tax or insurance advice. To ensure that your own circumstances have been properly considered and that action is taken based on the latest information available, you should obtain professional advice from a qualified tax, legal and/or insurance advisor before acting on any of the information in this article.